Why current retail banking industry should cease for a moment and change?

In Australia, Australian Competition & Consumer Commission (ACCC) is overlooking a new type of regulation for banks in Australia. Everything is based on a concept called Consumer Data Right (CDR). Purpose of CDR is to give consumers more control over their own data.

They are rolling out CDR across the economy starting with the banking industry. They have already started working on energy industry and planning to roll out into telecommunication industry as well.

What are consumer data ?

For a long period of time, banks have been keeping a lot of data belonging to consumers in addition to their personal identification data such as name, age etc. Most important data generated by banks are transaction, usage and product data (Financial services provided to the consumer expecting a Return On Investment). Old information systems in banks have never used these data for any reason, expecting to secure these data with out letting them out.

In 2020, large amounts of customer data produced by banks can be utilized to produce massive benefits towards the bank customer, thanks to the computational power, internet and devices available. This has to happen without letting this sensitive information go into unexpected hands as well.

Let’s take a very simple example. If the customer can know all fixed deposit rates and credit ratings of financial institutions available across Sri Lanka, he would probably go for the highest interest rate considering the the risk factor as well. Customer is capable of making the best financial decision.

If a consumer can know all the transactions that he did through the banks and analyze where his cash went, his future transactions will be more informed decisions. This is just the tip of the iceberg. Possibilities are endless and I think how the consumer benefits should be left to imagination.

Why Open Banking is a fantastic solution for Consumer Data Right ?

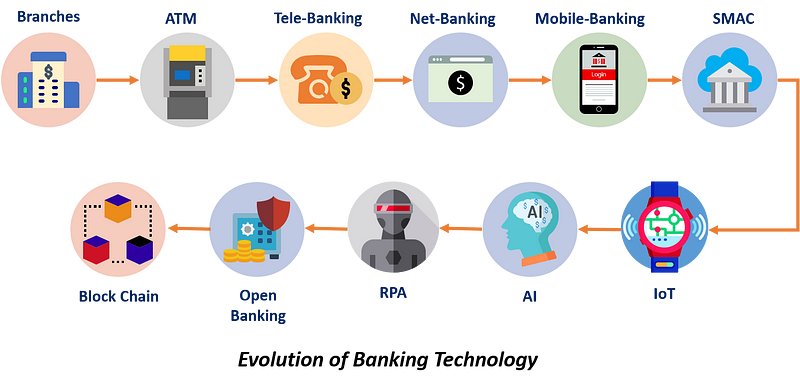

Banking industry has been very inconvenient for general consumer for a very long period of time, even after computer technology took over inefficient paper based systems. The existing information systems in the banks are still inefficient. Retail banking experience of the consumer still suffers.

Banking apps provided by different banks can be considered as a major step taken by banks for better consumer experience. One of the common problems consumers are facing today is their inability to remember so many passwords at once. For different apps from multiple banks, consumer will have multiple accounts. Either the consumer has to use a single bank and suffer from less profitable deals or use most profitable financial services from multiple banks and remember so many passwords at once. In all the cases consumer is penalized at the end. And unnecessary financial gains are experienced by the industry as a whole because of this inefficiency. This is why the government authorities need to step in.

Open banking:

Imagine there are so many banking apps provided not by a single bank, but facilitated by fintechs (Financial Technology Company specializing in providing a great customer experience (CX)). A single banking app is capable of providing the customer details of all the bank accounts(from different banks) he has and the transaction data. Application is capable of providing the user wide range of analysis as well. Consumer can easily access all his finances through a single authentication(password). Banks are also ready to instantly and securely provide the data to these fintechs when needed. Consumer is capable of instantly making payments to merchants through the same app. This is open banking.

Using a basic economics perspective, a government’s duty is to make sure the markets are fair and competitive so that consumers will not suffer from unfair prices and harmful supplier power.

Since all the banks are available through a single app, banks can no longer enjoy financial gains from barriers to change cash accounts quickly. If a financial product (for example debt) is too expensive (high interest on debt), consumer can easily find the cheapest service. Fintechs in the industry will need to provide better customer experience and interactive services to the customer in order to survive competition. This results in end customer benefiting at the end. It all makes sense because this is what a competition control authority of a country should do and in Australia ACCC is already working on it.

What about other countries?

Australia is not the leading country in Open Banking technology. The leading country is United Kingdom and the whole European Union is a part of this development. This is due to fast pace regulation implementation in these regions. Banks are forced to comply with regulations so that the government can make sure the citizens benefiting as soon as possible. Banks in USA has already begun working on Open Banking, without regulatory compliance. And other countries in Asia like Singapore and Japan are also a part of this. Hopefully general citizens around the world are expected to benefit from this massive change taking place. This will have very positive effect on the financial systems in respective countries as well. Their goal is to adopt digital currency as fast as possible. This will reduce fraud and illegal money laundering.

Hopefully, Sri Lanka will be a part of this change too, if the Central Bank of Sri Lanka takes the initiative in fostering this technology in the retail banking sector.