Ten subject areas of CFA in English - II

The five subjects explained below are quite specific to CFA studies. All of them were completely new for me when I started. I’m trying to explain these subjects from the view point of a level 1 exam completed student. I hope it would be an interesting view point to look at the curriculum, when getting ready to start working on level 1 exam. I believe these subjects would seem very different to look at from the view point of a CFA exam complete student or a person with ample amount of experience.

Have a look at the first part of this article through the following link.

Ten subject areas of CFA in English

Equity Investments

Equity investments is about the stock market as you have guessed. This is a large global market consisting of shares from different public companies. Learning the subject starts from market organization and structure.

Security market indices are very common in our experience. For example we see ASPI (All Share Price Index) market index in television news. A separate chapter explains how these different price indices are created. There are some calculations to get used to. A chapter called ‘market efficiency’ include very important theories that help candidates to understand the equity markets.

The subject ends with equity valuation techniques. This subject is a little bit hard compared to other subjects. It takes a lot of practice from practice questions. Some knowledge is very practical knowledge a person obtains from practical experience, but since we could be students with zero experience, the best way is to learn and understand through searching the web.

Fixed Income

Fixed income is among the hardest sub-topics to learn in the level 1 curriculum, because many find the subject material unfamiliar with the previous knowledge. Basically, this subject is about fixed return investments.

For example, we invest our cash in fixed deposits that return a fixed agreed percentage of return. We don’t need to worry about our return being lower than expected. Similarly, there are many different investment vehicles out their with a fixed return. For sophisticated investors, investing in bonds can be a good fixed investment. There are many other short term and long term fixed investments.

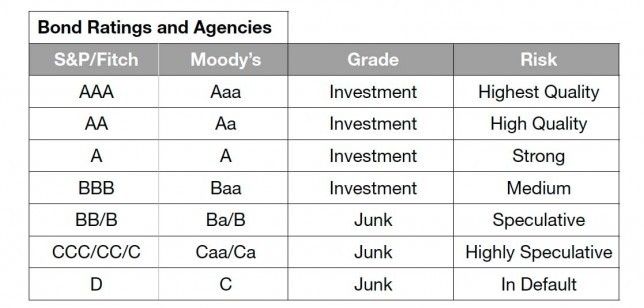

These type of investments are essential to include in an investment portfolio, due to the reason being people need to have some amount of money invested in risk free vehicles. Chapters focus on different types of bonds and calculations related to them. There is a lot of valuation and pricing related calculations a candidate needs to understand. There is ample amounts of formulae to remember for exam.

It is very remarkable to find that fixed income investments play a large role in the investment world with its huge international market that values up to $200 Trillion, which is very large compared to global equity market size.

Another interesting area is asset backed securities. These securities are not very commonly heard in Sri Lanka. I believe these securities are widely used in the USA, due to their sophisticated financial system. These chapters will be quite challenging to understand due to the unfamiliarity of the material for us, Sri Lankans. This chapter explains how securities can be issued by using issued loans as collateral. Then again these securities can be kept as collateral and new securities can be issued.

Derivatives

Derivatives is a comparatively short subject available in the curriculum for CFA level 1. Due to it’s small size one can quickly finish reading all the material in this subject. There is only two chapters in the level 1 curriculum. Derivatives can be quite hard to understand though.

Examples for derivatives include, option contracts, futures contracts and forward contracts. Valuation of these can be hard to understand, but most of the extremely hard calculations are not expected in the learning outcomes. The curriculum goes on explaining above example derivatives, their markets, valuation and pricing in two chapters.

Name ‘derivatives’ comes from the fact that these investment vehicle prices are derived from equities, fixed income, commodities or foreign exchange prices. In order to learn this subject, mathematical relationships and the common general knowledge about how the derivative market works should be understood well. A lot of practice questions include qualitative questions. Most of the learning come from practising questions and finding unresolved answers outside the curriculum as well.

Alternative Investments

Alternative investments includes investments that are alternative to mainstream vehicles. Usually people invest in either equities or fixed income investments. There are so many other investment vehicles available to invest. Investing in these can bring different pros and cons. Many cons from mainstream investments can be overcome through these investments.

In Level 1 exams, alternative investments include only a single chapter. This chapter is long, but it is easy to read and finish the subject.

Mostly discussed alternative investments include hedge funds, private equity, real estate, commodities and infrastructure. There are some calculations that involve valuing and pricing these investments. Also ability to compare alternative investments with mainstream investments is also important. There are unique benefits and risks related to specific alternative investments.

It is interesting to find private equity investments as a largely used alternative investment option by wealthy investors to increase their wealth. Private equity can be a very lucrative investment industry if properly approached.

Portfolio Management

Portfolio management subject name has some meaning of its constituents. The literal meaning of portfolio is ‘a large, thin, flat case for loose sheets of paper such as drawings or maps’. In this domain a portfolio of investments is a range of investments owned by an organization or a person.

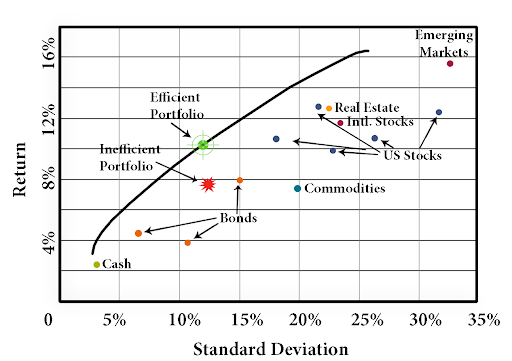

In our personal financing, we usually have fixed deposits, savings deposits, properties such as lands, vehicles etc. A more organized person can have a more sophisticated set of investments. Companies being large and active in the financial world, they need to be sophisticated in terms of their investments, because significant returns will be lost if this part is left ignored. The whole subject is about having multiple investments in different investment vehicles to diversify risk.

An in-depth look into interpreting the risk return profile of different investment vehicles is done in this subject. Studying for level 1 include, understanding several relationships represented through 2D graphs. Concepts like Security Market Line and Capital Market Line are essential to understand what the book explains throughout the section.

Final chapters in this area includes additional two chapters that include unrelated areas: Technical analysis and Fintech in investment Management. Technical analysis include different patterns observable in historical financial market data. There is a considerable amount of names to remember in this chapter.

Fintech in investment Management include emerging trends in the investment industry, that will shape the future of the industry. This chapter briefly covers machine learning, blockchain and robot investment advisers.

Conclusion

All ten subjects pose some challenge to a new level 1 candidate. I would say the challenge mainly exist due to the size of the syllabus as a whole. In level 1, non of the concepts provided are not too complicated to learn. Everything can be learnt very easily, but most of the stuff can be easily forgotten. 50% of the work is managing the time properly to achieve the climax of studying when the exam date comes.

If a certain subjects seems hard to conquer, probably it needs some time to properly digest. So better give time when it requires and stop spending unnecessary time for subject areas that you are very confident with. We are usually tempted to spend more time with what we are mostly capable of but better to spend time with what we are very weak at so that we avoid the chances of failure.

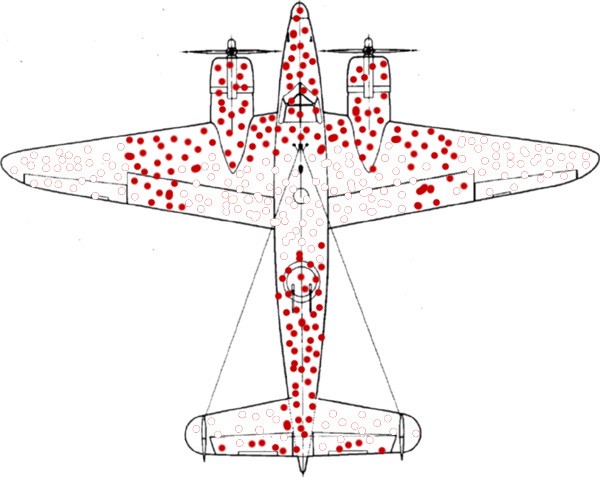

It is always better to strengthen weak points rather than spending time to reinforce already strong areas. This is called survivorship bias. You might have come across this internet post, that has been very popular in LinkedIn.

“The most famous example of survivorship bias dates back to World War Two. At the time, the American military asked mathematician Abraham Wald to study how best to protect airplanes from being shot down. The military knew armour would help, but couldn’t protect the whole plane or would be too heavy to fly well. Initially, their plan had been to examine the planes returning from combat, see where they were hit the worst – the wings, around the tail gunner and down the centre of the body – and then reinforce those areas.”

“But Wald realized they had fallen prey to survivorship bias, because their analysis was missing a valuable part of the picture: the planes that were hit but that hadn’t made it back. As a result, the military were planning to armour precisely the wrong parts of the planes. The bullet holes they were looking at actually indicated the areas a plane could be hit and keep flying – exactly the areas that didn’t need reinforcing.”